lppls is a Python module for fitting the LPPLS model to data.

The LPPLS model provides a flexible framework to detect bubbles and predict regime changes of a financial asset. A bubble is defined as a faster-than-exponential increase in asset price, that reflects positive feedback loop of higher return anticipations competing with negative feedback spirals of crash expectations. It models a bubble price as a power law with a finite-time singularity decorated by oscillations with a frequency increasing with time.

Try the demo:

Here is the model:

where:

-

$E[ln\ p(t)]$ : expected log price at the date of the termination of the bubble -

$t_c$ : critical time (date of termination of the bubble and transition in a new regime) -

$A$ : expected log price at the peak when the end of the bubble is reached at$t_c$ -

$B$ : amplitude of the power law acceleration -

$C$ : amplitude of the log-periodic oscillations -

$m$ : degree of the super exponential growth -

$\omega$ : scaling ratio of the temporal hierarchy of oscillations -

$\phi$ : time scale of the oscillations

The model has three components representing a bubble. The first,

- Official source code repo: https://github.com/Boulder-Investment-Technologies/lppls

- Download releases: https://pypi.org/project/lppls/

- Issue tracker: https://github.com/Boulder-Investment-Technologies/lppls/issues

Dependencies

lppls requires:

- Python (>= 3.7)

- Matplotlib (>= 3.1.1)

- Numba (>= 0.51.2)

- NumPy (>= 1.17.0)

- Pandas (>= 0.25.0)

- SciPy (>= 1.3.0)

- Pytest (>= 6.2.1)

User installation

pip install -U lppls

from lppls import lppls, data_loader

import numpy as np

import pandas as pd

from datetime import datetime as dt

%matplotlib inline

# read example dataset into df

data = data_loader.nasdaq_dotcom()

# convert time to ordinal

time = [pd.Timestamp.toordinal(dt.strptime(t1, '%Y-%m-%d')) for t1 in data['Date']]

# create list of observation data

price = np.log(data['Adj Close'].values)

# create observations array (expected format for LPPLS observations)

observations = np.array([time, price])

# set the max number for searches to perform before giving-up

# the literature suggests 25

MAX_SEARCHES = 25

# instantiate a new LPPLS model with the Nasdaq Dot-com bubble dataset

lppls_model = lppls.LPPLS(observations=observations)

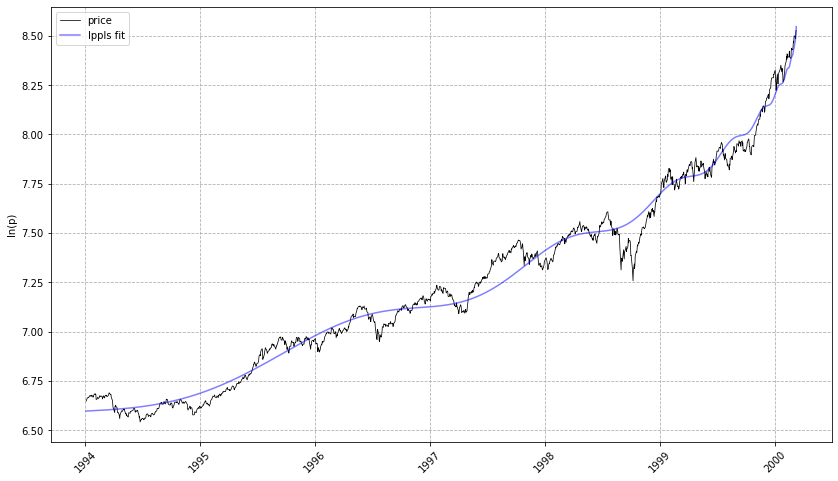

# fit the model to the data and get back the params

tc, m, w, a, b, c, c1, c2, O, D = lppls_model.fit(MAX_SEARCHES)

# visualize the fit

lppls_model.plot_fit()

# should give a plot like the following...# compute the confidence indicator

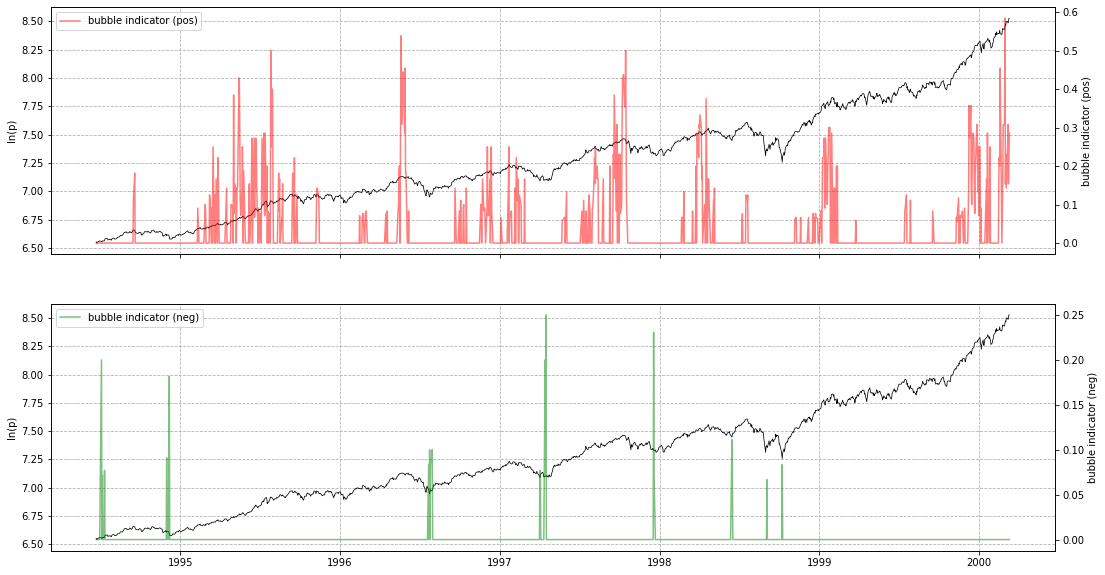

res = lppls_model.mp_compute_nested_fits(

workers=8,

window_size=120,

smallest_window_size=30,

outer_increment=1,

inner_increment=5,

max_searches=25,

# filter_conditions_config={} # not implemented in 0.6.x

)

lppls_model.plot_confidence_indicators(res)

# should give a plot like the following...If you wish to store res as a pd.DataFrame, use compute_indicators.

Based on the work in Zhang, Zhang & Sornette 2016, quantile regression for LPPLS uses the L1 norm (sum of absolute differences) instead of the L2 norm and applies the q-dependent loss function during calibration. Please refer to the example usage here.

Shu and Zhu (2019) proposed CMA-ES for identifying the best estimation of the three non-linear parameters (

The CMA-ES rates among the most successful evolutionary algorithms for real-valued single-objective optimization and is typically applied to difficult nonlinear non-convex black-box optimization problems in continuous domain and search space dimensions between three and a hundred. Parallel computing is adopted to expedite the fitting process drastically.

This approach has been implemented in a subclass and can be used as follows... Thanks to @paulogonc for the code.

from lppls import lppls_cmaes

lppls_model = lppls_cmaes.LPPLSCMAES(observations=observations)

tc, m, w, a, b, c, c1, c2, O, D = lppls_model.fit(max_iteration=2500, pop_size=4)Performance Note: this works well for single fits but can take a long time for computing the confidence indicators. More work needs to be done to speed it up.

- Filimonov, V. and Sornette, D. A Stable and Robust Calibration Scheme of the Log-Periodic Power Law Model. Physica A: Statistical Mechanics and its Applications. 2013

- Shu, M. and Zhu, W. Real-time Prediction of Bitcoin Bubble Crashes. 2019.

- Sornette, D. Why Stock Markets Crash: Critical Events in Complex Financial Systems. Princeton University Press. 2002.

- Sornette, D. and Demos, G. and Zhang, Q. and Cauwels, P. and Filimonov, V. and Zhang, Q., Real-Time Prediction and Post-Mortem Analysis of the Shanghai 2015 Stock Market Bubble and Crash (August 6, 2015). Swiss Finance Institute Research Paper No. 15-31.

- Zhang, Q., Zhang, Q., and Sornette, D. Early Warning Signals of Financial Crises with Multi-Scale Quantile Regressions of Log-Periodic Power Law Singularities. PLOS ONE. 2016. DOI:10.1371/journal.pone.0165819