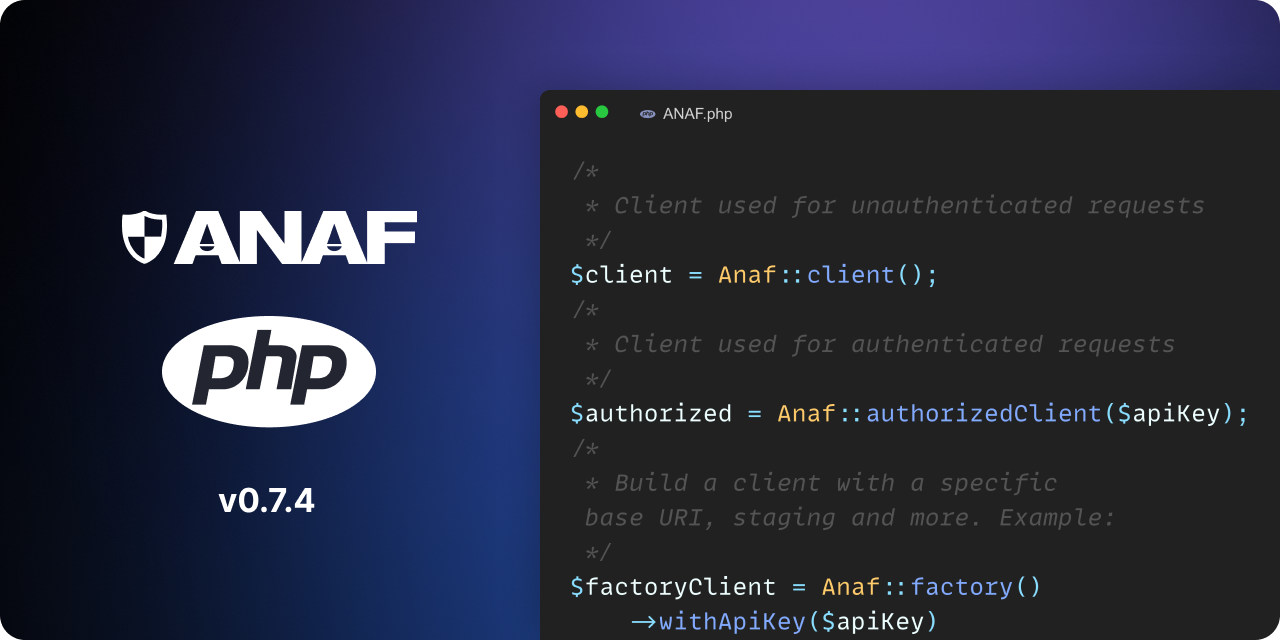

ANAF PHP is a PHP API client that allows you to interact with the ANAF Web Services.

Requires PHP 8.1+

First, install ANAF via the Composer package manager:

composer require andalisolutions/anaf-phpThen, you can create ANAF client in two ways:

/*

* Client used for unauthenticated requests

*/

$client = Anaf::client();

/*

* Client used for authenticated requests

*/

$authorizedClient = Anaf::authorizedClient($apiKey);

/*

* Build a client with a specific base URI, staging and more. Example:

*/

$factoryClient = Anaf::factory()

->withApiKey($apiKey)

->staging()

->withBaseUri('https://webservicesp.anaf.ro')

->make(); You can obtain API key using oauth2-anaf package.

- Obtaining public information in the financial statements/annual accounting reports related to economic agents. (Docs)

- Get info about companies using

TAX IDENTIFICATION NUMBER(CUI/Vat Number). (Docs) - Get info about taxpayers who are registered in the Register of farmers who apply the special regime (Docs)

- Get info about taxpayers who are registered in the Register of religious entities/units (Docs)

- Accessing the functionalities offered by the SPV (Docs)

- The national system regarding the electronic invoice RO e-Factura (Docs)

- The integrated electronic system RO e-Transport (Docs)

Balance Sheet Resource

Get public information in the financial statements/annual accounting reports related to economic agents

$balanceSheet = $client()->balanceSheet()->create([

'cui' => '12345678',

'an' => 2019,

]);

$balanceSheet->year;

$balanceSheet->tax_identification_number;

$balanceSheet->company_name;

$balanceSheet->activity_code;

$balanceSheet->activity_name;

$balanceSheet->indicators; // array

$balanceSheet->indicators['AVERAGE_NUMBER_OF_EMPLOYEES']->value;

$balanceSheet->indicators['NET_LOSS']->value;

$balanceSheet->indicators['NET_PROFIT']->value;

$balanceSheet->indicators['GROSS_LOSS']->value;

$balanceSheet->indicators['GROSS_PROFIT']->value;

$balanceSheet->indicators['TOTAL_EXPENSES']->value;

$balanceSheet->indicators['TOTAL_INCOME']->value;

$balanceSheet->indicators['NET_TURNOVER']->value;

$balanceSheet->indicators['HERITAGE_OF_THE_KINGDOM']->value;

$balanceSheet->indicators['PAID_SUBSCRIBED_CAPITAL']->value;

$balanceSheet->indicators['CAPITAL_TOTAL']->value;

$balanceSheet->indicators['PROVISIONS']->value;

$balanceSheet->indicators['ADVANCE_INCOME']->value;

$balanceSheet->indicators['LIABILITIES']->value;

$balanceSheet->indicators['PREPAYMENTS']->value;

$balanceSheet->indicators['HOME_AND_BANK_ACCOUNTS']->value;

$balanceSheet->indicators['DEBT']->value;

$balanceSheet->indicators['INVENTORIES']->value;

$balanceSheet->indicators['CURRENT_ASSETS']->value;

$balanceSheet->indicators['FIXED_ASSETS']->value;

$balanceSheet->toArray(); // ['year' => '', 'tax_identification_number' => '', 'company_name' => '' ...]For balance sheets, the indicators may vary depending on the type of company, as specified by ANAF. I recommend you to use var_dump to observe the type of indicators. The vast majority of companies have the indicators from the example above

Info Resource

Get info about the company or multiple companies.

$companyInfo = $client->info()->create([

[

'cui' => '12345678',

'data' => '2021-01-01',

],

[

'cui' => '222222',

'data' => '2021-01-01',

]

]);

/*

* If you send one array, for one company, you will receive a CreateResponse object with the structure below.

* If you send multiple arrays, for multiple companies, you will receive a CreateResponses object with an array

* with CreateResponse objects.

*/

$companyInfo->generalData;

/* Accessible information in general data */

$companyInfo->generalData->companyName;

$companyInfo->generalData->address;

$companyInfo->generalData->registrationNumber;

$companyInfo->generalData->phone;

$companyInfo->generalData->fax;

$companyInfo->generalData->postalCode;

$companyInfo->generalData->document;

$companyInfo->generalData->registrationStatus;

$companyInfo->generalData->registrationDate;

$companyInfo->generalData->activityCode;

$companyInfo->generalData->bankAccount;

$companyInfo->generalData->roInvoiceStatus;

$companyInfo->generalData->authorityName;

$companyInfo->generalData->formOfOwnership;

$companyInfo->generalData->organizationalForm;

$companyInfo->generalData->legalForm;

$companyInfo->vatRegistration;

/* Accessible information in vat registration */

$companyInfo->vatRegistration->status;

//vatPeriods is an array from ANAF v8

$companyInfo->vatRegistration->vatPeriods[0]->startDate

$companyInfo->vatRegistration->vatPeriods[0]->stopDate;

$companyInfo->vatRegistration->vatPeriods[0]->stopEffectiveDate;

$companyInfo->vatRegistration->vatPeriods[0]->message;

$companyInfo->vatAtCheckout;

/* Accessible information in vat at checkout */

$companyInfo->vatAtCheckout->startDate;

$companyInfo->vatAtCheckout->stopDate;

$companyInfo->vatAtCheckout->updateDate;

$companyInfo->vatAtCheckout->publishDate;

$companyInfo->vatAtCheckout->updatedType;

$companyInfo->vatAtCheckout->status;

$companyInfo->inactiveState;

/* Accessible information in inactive state */

$companyInfo->inactiveState->inactivationDate;

$companyInfo->inactiveState->reactivationDate;

$companyInfo->inactiveState->publishDate;

$companyInfo->inactiveState->deletionDate;

$companyInfo->inactiveState->status;

$companyInfo->splitVat;

/* Accessible information in split tva */

$companyInfo->splitVat->startDate;

$companyInfo->splitVat->stopDate;

$companyInfo->splitVat->status;

$companyInfo->hqAddress;

/* Accessible information in hq address */

$companyInfo->hqAddress->street;

$companyInfo->hqAddress->no;

$companyInfo->hqAddress->city;

$companyInfo->hqAddress->cityCode;

$companyInfo->hqAddress->county;

$companyInfo->hqAddress->countyCode;

$companyInfo->hqAddress->countyShort;

$companyInfo->hqAddress->country;

$companyInfo->hqAddress->details;

$companyInfo->hqAddress->postalCode;

$companyInfo->fiscalAddress;

/* Accessible information in fiscal address */

$companyInfo->fiscalAddress->street;

$companyInfo->fiscalAddress->no;

$companyInfo->fiscalAddress->city;

$companyInfo->fiscalAddress->cityCode;

$companyInfo->fiscalAddress->county;

$companyInfo->fiscalAddress->countyCode;

$companyInfo->fiscalAddress->countyShort;

$companyInfo->fiscalAddress->country;

$companyInfo->fiscalAddress->details;

$companyInfo->fiscalAddress->postalCode;

// You can use all resources as array

$companyInfo->toArray(); // ["general_data" => ["tax_identification_number" => '', "company_name" => ''...]..]

// or

$companyInfo->generalData->toArray(); // ['tax_identification_number' => '', 'company_name' => ''...]

Ngo Resource

Checking NGO taxpayers who are registered in the Register of religious entities/units

$entityInfo = $client->ngo()->create([

[

'cui' => '12345678',

'data' => '2021-01-01',

]

]);

$entityInfo->taxIdentificationNumber;

$entityInfo->searchDate;

$entityInfo->entityName;

$entityInfo->address;

$entityInfo->phone;

$entityInfo->postalCode;

$entityInfo->document;

$entityInfo->registrationStatus;

$entityInfo->startDate;

$entityInfo->endDate;

$entityInfo->status;

// You can use all resources as array

$entityInfo->toArray(); // ["tax_identification_number" => '', "entity_name" => ''...]eFactura Resource

Upload Resource

Upload an XML (eFactura) file to the SPV

TODO: improve error handling

$upload = $authorizedClient->efactura()->upload(

xml_path: $pathToXmlFile,

taxIdentificationNumber: '12345678',

//standard: UploadStandard::UBL, // default value is UBL

//extern: false, // default value is false

//selfInvoice: false, // default value is false

);

$upload->responseDate, // 202401011640

$upload->executionStatus,

$upload->uploadIndex,Status Resource

TODO: implement status from here

Messages Resource

TODO: implement paginated messages from here

Get the list of available messages

$spvMessages = $authorizedClient->efactura()->messages([

'zile' => 30, // between 1 and 60

'cif' => '12345678',

]);

$spvMessages->messages; // array

$spvMessages->serial;

$spvMessages->taxIdentificationNumbers;

$spvMessages->title;

$message = $spvMessages->messages[0];

$message->creationDate,

$message->taxIdentificationNumber,

$message->solicitationId,

$message->details,

$message->type,

$message->id,Download - eFactura XML Resource

Get a file from the SPV identified by the id received from the messages endpoint

$file = $authorizedClient->efactura()->download([

'id' => '12345678',

]);

$file->getContent(); // string - You can save/download the content to a fileValidate Resource

TODO: implement validate from here

XmlToPdf Resource

Convert XML eFactura to PDF. For this endpoint you need to use unauthenticated client

/*

* $xmlStandard can be one of the following: 'FACT1', 'FCN'.

* The default value is 'FACT1'

*/

$file = $client->efactura()->xmlToPdf($pathToXmlFile, $xmlStandard);

$file->getContent(); // string - You can save the pdf content to a fileANAF PHP is an open-sourced software licensed under the MIT license.